Clearly it’s about more than just complying with regulations or even principles like ‘treating customers fairly.’ And not just the AoV which attempts the same or the SMCR, which tends to be too role specific and where training is used mainly to demonstrate compliance rather than understanding.

But most of those who will be subject to the duty are racking their brains to try and understand what it actually means; and more important how they can comply in a way that keeps the FCA off their backs. On whom does the duty fall? On the board of the firm, so will it form an element of the AoV? On all employees whether in the AFM or in a TPA or at a depositary?

We are waiting for final detail once the consultation is finished. But it is hard to see how the new principle adds anything to the existing regulatory landscape. The Investment Association, in its response, has argued:

“Rather than providing a point of simplification in a complex regulatory landscape, the addition of further rules which aim to cover the entirety of retail financial services without reference to, or consideration of, existing rules risks creating undue complexity and bureaucracy (in terms of evidence gathering, record keeping, policy writing) for those firms which are subject to detailed rules, without changing behaviours in parts of the market where change is really needed.”

Industry structure will make practical fulfilment to the ‘duty’ hard.

One of the problems that investment firms will face when trying to engage with the spirit of the principle is the way that most investment fund management businesses are now structured. Different parts of the manufacturing and distribution process are increasingly fragmented and, even in the case of an AFM that carries out all the functions in house, operations will fall into in different silos. This can be illustrated by looking at the key outcomes that the FCA wishes to see:

Products and services (designed to meet consumers’ needs)

Products are typically designed by the AFM that acts as its own ACD; or in the case of an external ACD (rent a fund manager structure) by the appointed investment manager. The marketing department perhaps in consultation with the fund managers comes up with a product concept, which, if approved by someone with decision making capacity higher up the ladder will go to legal and compliance for a full prospectus to be authorised. Now we are ready to go.

Consumer understanding (communications tailored in helping consumers making informed decisions)

Somewhere else a specialist team is busy writing KIIDs and marketing material, whose form and nature will depend on the distribution channels decided on. If through the network of advisers, discretionary portfolio advisers and platforms, education to ensure that the end customers are helped to make right decisions: and more important promotion to ensure that that it gets on the top shelf (in supermarket terms)

Customer services (ongoing support throughout customer relationship)

It is probable that the point at which customers carry out transactions, have their ownership recorded and from which they subsequently receive reports and communications will not be the AFM or even if the AFM is the external ACD but a third-party administrator. So ongoing support may not be from the that part of the spider’s web of interlocking actors that originally designed the product and the marketing communications. Not even mentioned is the service provided by the most expensive part of the mechanism, managing the investments. This is not part of a day-to-day customer facing relationship but in reality what most customers pay for.

Price and value (giving fair value to consumers).

Price is something that consumers have really understood. The relentless promotion of low cost or indexed products, eating up the available investors’ money, is what has driven active mangers to reduce their fees to compete. It is not a result of their self-analysis or pressure from non-executive directors. Now active managers are all busy trying to find ways to create premium products that would justify higher fees and are hard for the low-cost indexers to compete with – ESG funds or alternative funds for the time being fall into this category. Also, value is also more than just price. Good support to answer questions or deal with complaints should also play their part and the desks that deal with customer enquiries and support, or answer complaints are equally important. Furthermore, the price tag on the product itself is not the only cost to the end customer. There is a series of rent seeking firms in the distribution chain – advisers, platforms DPMs et al.

Now we have lots of people who individually or collectively have a consumer duty:

How on earth to amalgamate these disparate fragments to forge a single whole, which will be our verifiable overall consumer duty model? Imagine writing separate parts for each instrument in the orchestra without imaging how the symphony will sound when they all play together. Never forget Eric Morecombe’s immortal justification “I’m playing all the right notes. But not necessarily in the right order.” And, as the conductor of the orchestra trying to ensure that the oboes and violins are both are playing the right notes for their part the only way is to train and test each separately. But even then the whole symphony doesn’t sound quite right because the notes are not in the right order.

Virtue by regulation

So, the FCA has discovered that regulating each disconnected bit in detail doesn’t seem to achieve the desired result. And it is now trying to make everyone virtuous by regulation.

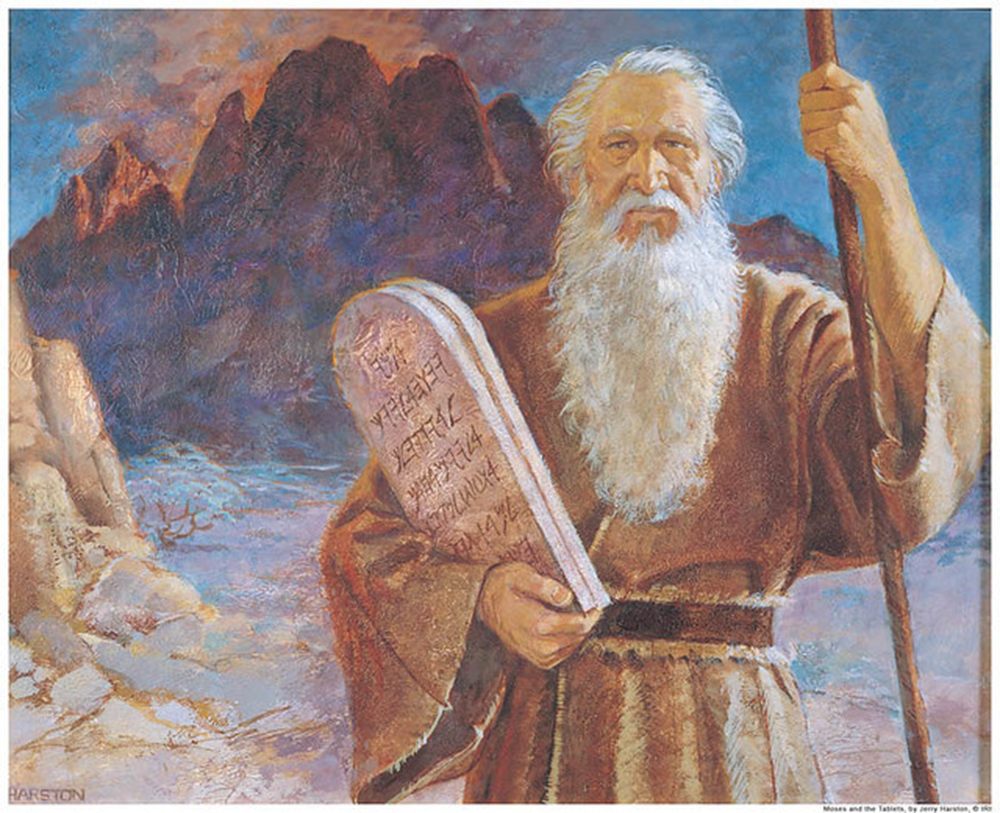

A good example of an attempt to design a simpler way to virtue than by complying with voluminous regulations. The ten commandments; clear, short and to the point. We all know those (well maybe). Let us just imagine God (as if the FCA) reviewing his principles and testing compliance with his commandments.

God’s conclusions

| Product design | Pretty good. I designed them for the human race myself |

| Value for money | They are free |

| Marketing material | I got four gospels written to promote the words spoken by my beloved son |

| Point of sale | Good distribution. Thousands of churches where customers can get regular information and support. But not enough attend. |

| Review and testing | Not entirely satisfactory. Still too much killing, theft, and adultery. And too many people taking my name in vain. |

| Information exchange | Lots of false gods being worshipped so I don’t get good feedback from prayers to me |

| Customer support | Not enough loving of neighbours by virtuous people |

But as you see they ain’t really achieving their objectives. So back to detailed regulations. Getting hanged for murder or being whipped for adultery or burned at the stake for worshipping false gods. But make sure you aren’t caught. So, hide your sins under a veneer of respectability. How?

Success to the bureaucrats

Easy! Lots of mechanical and bureaucratic processes. These will be designed to ensure that every element is exhaustively documented, signed off by a senior manager (well qualified by having been trained by the SMCR – lots of good training courses available) and, of course, approved by the board in particular the non-executive directors. Will form part of a self-congratulatory AoV. New consumer duty fulfilment departments with managers and staff highly trained to understand consumer needs and document each detail of how the duty is being fulfilled. Result: FCA happy. And consumers too?

Levity apart, all the FCA is trying to do is to ensure that those who purvey financial services are honest, truthful, well behaved and deal fairly with their customers. Most well-run businesses do that anyway. But, in trying to regulate virtue the FCA is going about it as if they will succeed where the Supreme Being has, so far, failed.